Highlights:

- The central bank of China has asked Jack Ma’s Ant Group to shake up its lending and other consumer finance operations

- The authorities criticised Ant for sub-par corporate governance, contempt for regulatory requirements, and involvement in regulatory arbitrage

- The central bank reported that Ant used his dominance to eliminate rivals

Chinese regulators have asked the online financial titan Ant Group Co. of Jack Ma to return to its payment roots, threatening to curb growth in its most lucrative consumer loan and wealth management businesses.

The Central Bank summoned executives of Ant over the weekend and ordered them to “rectify” the lending, insurance and wealth management services of the firm, the People’s Bank of China said in a statement Sunday. While it stopped short of specifically calling for the company’s break up, the central bank stressed that Ant needed to “understand the need of overhauling it’s business” and come up with a time.

The series of edicts pose a significant threat to the growth of the online finance empire of Ma, which has steadily evolved over the past 17 years from a PayPal-like operation into a complete suite of services. Ant was poised for a public listing that would have priced it at more than $300 billion before regulators interfered. The Hangzhou-based company now needs to move forward with the establishment of a separate financial holding company to ensure that it has enough capital and safeguard private personal data, the central bank said.

A Beijing-based analyst, Zhang Xiaoxi, at Gavekal Dragonomics said, “This is the culmination of a series of regulations and sets the direction for the business of Ant going forward.” He added further, “We have yet to see a clear indication of a break-up.” Ant is a giant player in the world and it must be cautious of any breakup.”

Authorities have blasted Ant for sub-par corporate governance, neglect of regulatory standards and participation in regulatory arbitration. Ant has used its supremacy to exclude competitors, damaging the interests of its hundreds of millions of customers, according to the central bank.

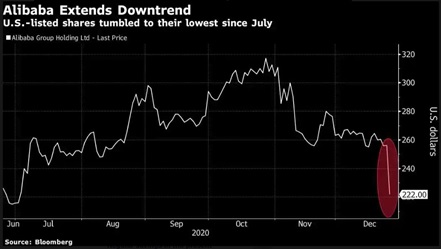

Last week, China escalated its investigation of the twin pillars of the internet domain of billionaire Ma, when an inquiry into suspected monopolistic practices was also initiated at Ant affiliate Alibaba Group Holding Ltd. The e-commerce firm’s U.S.-listed shares toppled the most ever on news of the probe.

According to a Saturday article posted on a news app operated by the Zhejiang Daily, the State Administration for Market Regulation dispatched investigators to Alibaba on Thursday and the on-site investigation was completed on the day. The study quoted an unnamed official from the watchdog for local market regulation in the province of Zhejiang, where Alibaba is centered.

The pressure on Jack Ma is significant to a broader effort aimed at curbing the increasingly dominant internet sphere.

Once hailed as drivers of economic growth and icons of the technological prowess of the country, the empires established by Ma, Tencent Holdings Ltd.’s chairman, “Pony” Ma Huateng, and other tycoons are now under scrutiny after acquiring hundreds of millions of users and gaining control over almost every aspect of everyday life in China.

A person familiar with the matter has said that Jack Ma’s own empire is in crisis. As the Ant Group is under the regulatory scrutiny, as of early December, the man most closely identified with the meteoric rise of China Inc. was communicated by the government to remain in the country. Since November, when regulators torpedoed what would have been a record $35 billion debut for Ant, Alibaba has lost more than $200 billion in market value.

His top executives are part of a task force with watchdogs who already have almost regular interactions. Regulators, including the China Banking and Insurance Regulatory Commission, meanwhile, are weighing which businesses Ant should give up power over in order to contain the risks it poses to the economy, said the officials who have the knowledge of the matter. They have not decided on whether to segment their various lines of operation, divide their online and offline services, or fully take a different route.