Highlights:

- If cases continue to rise, says Kaushik Das, chief India economist at Deutsche Bank, it will cost the economy and the impact on growth will be felt in April to June quarter.

- Despite a nationwide vaccination drive, new coronavirus cases have emerged in India in recent weeks.

- Unlike other Covid-affected countries, India has been reluctant to reimpose any additional restrictions.

A spike in coronavirus cases in India could damage the country’s recovery from a rare recession, as restrictions to prevent a new outbreak causing delays in rehiring millions of people who lost their jobs as a result of the lockdown across the country.

In the Reserve Bank of India’s latest monthly bulletin, central bankers led by Deputy Governor Michael Debabrata Patra wrote, “There is a restless urgency in the air in India to resume high growth, and incoming data point to even contact-intensive services such as personal care, leisure, and hospitality gathering traction.” “However, despite learning from the initial experience of living with the virus, another outbreak, more lockdowns and restraints, will become intolerable.” But “another outbreak, more lockdowns and restraints, will become unbearable in spite of learning from the initial experience of living with the coronavirus.”

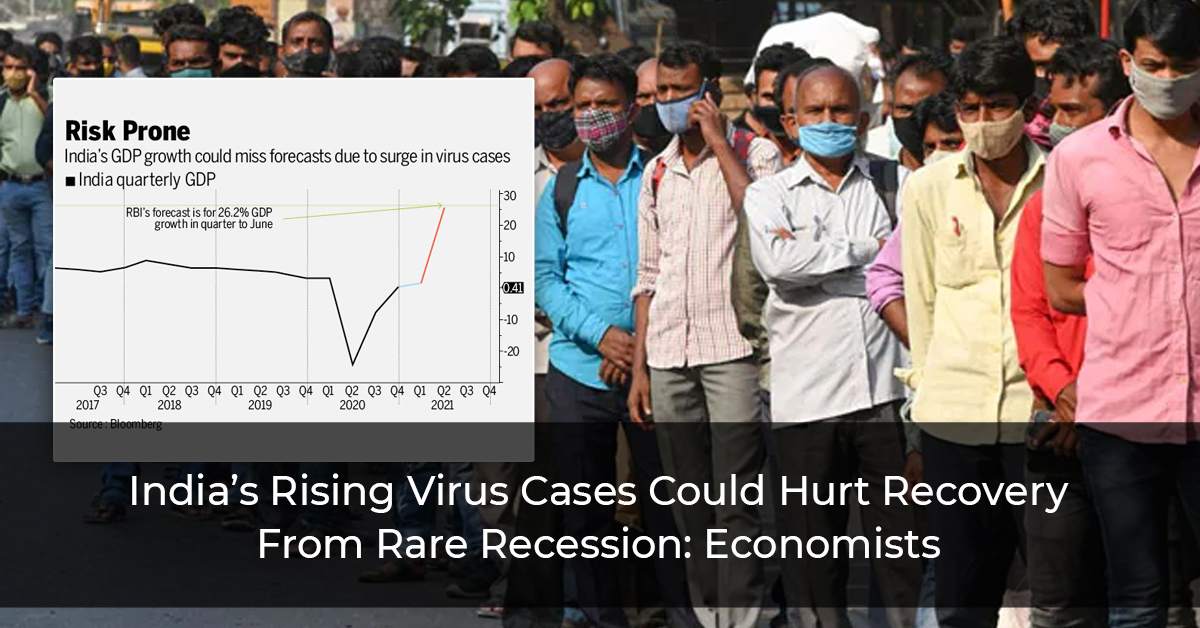

The RBI’s previous year-on-year growth forecast of 26.2 percent for the April to June quarter is seen as a cautionary footnote. If cases of coronavirus continue to increase, says Kaushik Das, chief India economist at Deutsche Bank AG in Mumbai, it will impact the economy and the effect on growth will be felt in the April to June quarter.

Kaushik Das, further added, ” We have already taken a lower real GDP growth estimate for April-June of 25.5 percent year-on-year, compared to the RBI’s forecast, in anticipation of such a possible rise in Covid-19 cases.”

Despite a nationwide vaccination campaign, new coronavirus cases have risen in India in recent weeks. The number of confirmed infections has grown to more than 40,000 per day, up from a low of about 9,800 in February, bringing the total number of infections to more than 11.5 million.

Unlike other Covid-19-affected regions, such as Europe, India has been hesitant to reimpose any new restrictive measures. Prime Minister Narendra Modi ordered a strict national lockdown with only a few hours’ notice around this time last year, unintentionally causing an exodus of millions of city-dwelling workers back to their villages rather than starve without work, spreading the virus across the country and causing severe economic damage.

Also Read: Around 32 Million Indians Pushed Out Of Middle Class Due To Pandemic, Says Pew Research

The most recent outbreak has been focused in Maharashtra, which accounts for 14.5 percent of India’s GDP and is home to the country’s financial capital, Mumbai. At a time when unemployment is rising, some Maharashtra districts have reverted to lockdowns.

According to the think tank Centre for Monitoring Indian Economy, India’s unemployment rate jumped to 6.9% in February from 6.5 percent in January.

While official data show the hospitals in cities have not reached full capacity, economists point to India’s weakened banking sector and vulnerable fiscal position as major sources of economic risk.

“The recent surge in infections, a waning fiscal reaction, and balance sheet stresses are likely to hamper India’s recovery,” said Priyanka Kishore, head of South and Southeast Asia economics at Oxford Economics in Singapore. According to her, economic momentum slowed significantly from January to March, and she believes it will continue to do so in the coming months, putting a drag on growth.

Ms Kishore continued, ” Monetary conditions are expected to remain accommodative through 2021, with the fiscal stimulus starting to wane in the second quarter.”

The monetary policy committee of the Reserve Bank of India will meet early next month to decide on interest rates, which are widely expected to remain at record lows.